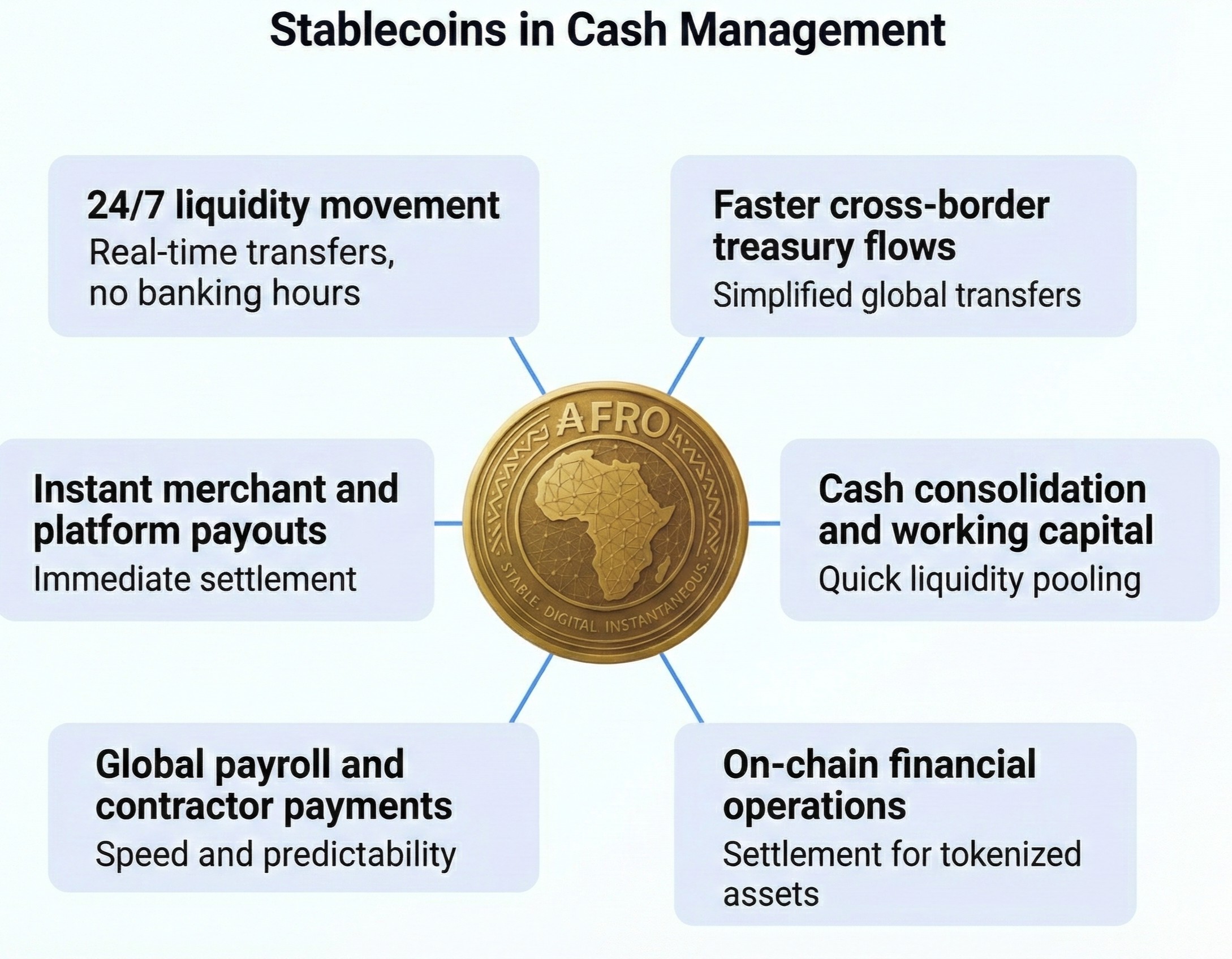

₳FRO Stablecoins: not just digital money - a new layer for cash management

There's a lot of buzz around stablecoins, often described simply as "digital money." My view is that Stablecoins combine clearing and settlement in one step in real time, safe value storage, making them increasingly relevant to cash and cash management operations.

Combined with a robust infrastructure and core banking platform like SUREBANQA, they (FRO+LOOP+SWAPPIFI+AFROSYNQ) are replacing banks - individuals and companies are becoming their own bank for financing, reconciliation and integration - while offering new capabilities that traditional banking rails cannot yet match.

🔹 24/7 liquidity movement

Transfers at any time, without cuts or operational windows.

🔹 Accelerating cross-border cash flows

Almost instantaneous global transfers with fewer intermediaries.

🔹 Instant Payments from Merchants and Platforms

Immediate settlement for markets, concert platforms and PSPs (Payment Services Provider)

🔹 Cash consolidation and working capital optimization

Quickly move liquidity between entities to improve visibility and reduce trapped liquidity.

🔹 Financial Chain Operations

Serve as a settlement asset for tokenized instruments and programmable cash flows.

🔹 Local and Global Payroll and Entrepreneur Payments

Streamlined disbursements between countries with a predictable timeframe.

As stablecoins evolve, they become more than a payment tool - they appear as a new layer of financial infrastructure for real-time, global, programmable cash management.

#stablecoins #payments #digital accreditions #treasure #cashmanagement #fintech #blockchain #afrosynq #afrotellers #tokenization #realtimepayments #innovation #financetransformation #cbdc #financialinfrastructure ##financialinclusion #userowned #africarising 7