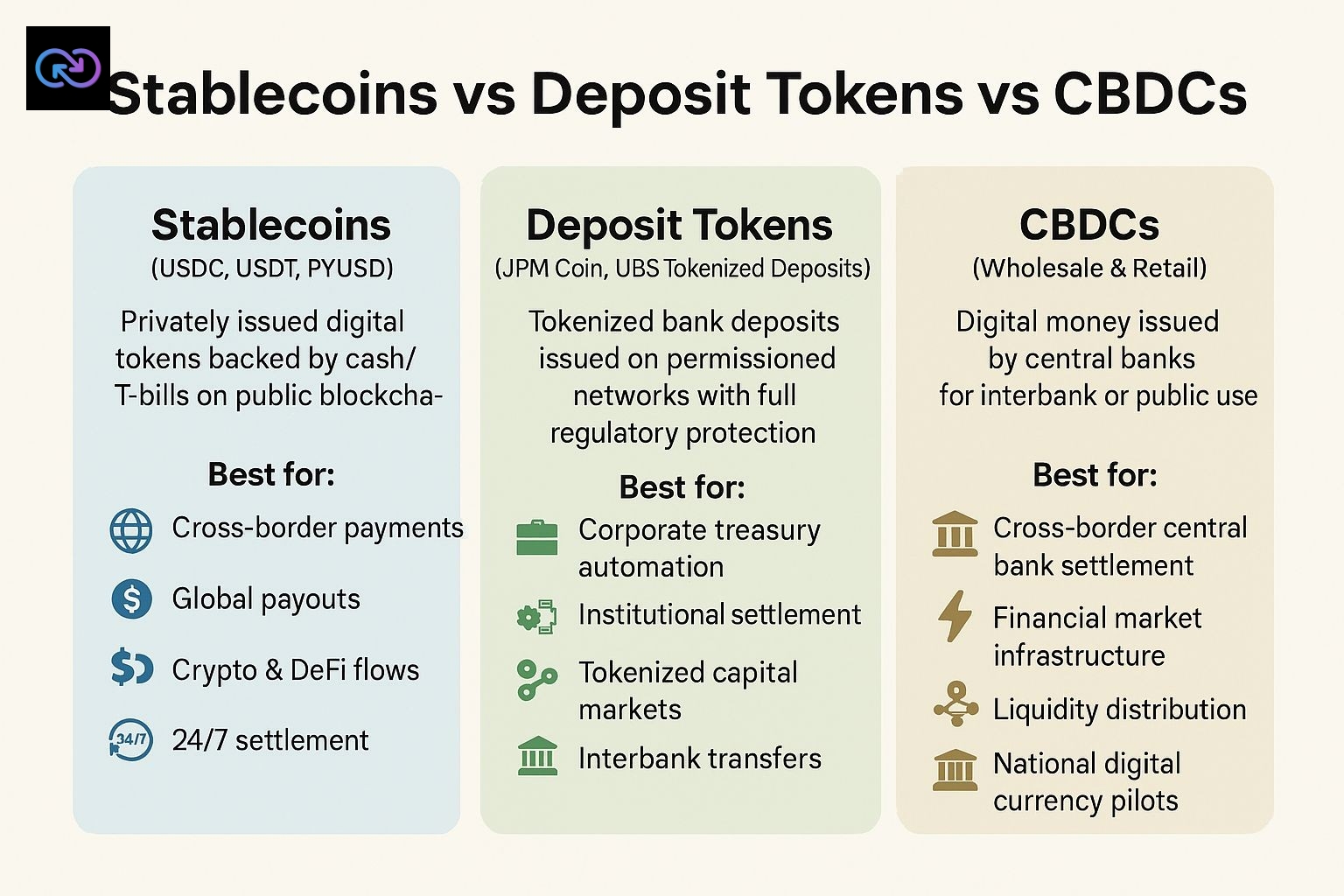

💡 Not all digital money is created equal ! What is the difference between Stablecoins, Deposit Tokens, and CBDCs ? 💸

Here’s a simple breakdown 👇

1️⃣ Stablecoins (USDC, USDT, PYUSD): Privately issued tokens backed by cash/T-bills on public blockchains.

👉 Best for: 🌍 cross-border payments, 💸 global payouts, 🧩 crypto & DeFi flows, and 24/7 settlement.

✅ Fast and global with issuer & regulatory risk.

2️⃣ Deposit Tokens (JPM Coin, UBS Tokenized Deposits):

Tokenized versions of bank deposits issued on permissioned networks with full regulatory protection.

👉 Best for: 🏢 corporate treasury automation, 🔄 institutional settlement, ⚙️ tokenized capital markets, and interbank transfers.

✅ Same legal claim as a bank deposit —> ideal for regulated, high-value flows.

3️⃣ CBDCs (Wholesale & Retail): Digital money issued by central banks for interbank or public use.

👉 Best for: 🏛️ G2G cross-border central bank settlement, ⚡ financial market infrastructure, 🔗 liquidity distribution, and national digital currency pilots like mBridge or Digital Dirham.

✅ "Safest" form of digital money but retail rollout still cautious due to policy and privacy considerations.

Each model plays a different role:

🔹 Stablecoins = speed & global reach

🔹 Deposit Tokens = institutional-grade trust

🔹 CBDCs = sovereign settlement backbone.

💭 The future isn’t about choosing one, it is about how all three interact to form a programmable global monetary layer.

#stablecoins #cbdc #tokenization #fintech #digitalassets #payments #blockchain #bankinginnovation #treasury #financialinclusion #web3 #regtech #futureofmoney #rwa #afro