Discover posts

Explore captivating content and diverse perspectives on our Discover page. Uncover fresh ideas and engage in meaningful conversations

INCLUSION FINANCIÈRE OU INCLUSION DE PAIEMENT ?

Le Dr Franklin Noll, spécialiste des paiements qui travaille en tant que responsable à la Federal Reserve Bank de Kansas City, a publié sur LinkedIn un article intéressant sur l'inclusion financière et de paiement. Il a exprimé ses propres opinions, et non celles de la Federal Reserve Bank.

«Je pense que nous devons réorienter le débat sur l’inclusion financière. En fait, la conversation en cours porte sur l’inclusion des paiements.

La Banque mondiale définit l'inclusion financière de la manière suivante : «L'inclusion financière signifie que les individus et les entreprises ont accès à des produits et services financiers utiles et abordables qui répondent à leurs besoins… fournis de manière responsable et durable. » Cela pourrait inclure des prêts, des assurances, etc. ...

Mais la plupart des recherches et des discussions sur l'inclusion financière portent en réalité sur les paiements, et non sur les autres services financiers.

Je définirais l’inclusion des paiements de cette façon : l’inclusion des paiements fait référence à la capacité d’un consommateur à effectuer et à recevoir des paiements de la manière qui correspond le mieux à ses besoins, quelle que soit sa situation, qu’elle soit financière, éducative, sociale ou culturelle. Et lorsque vous entendez des gens parler d’inclusion des paiements, ils parlent en réalité de la manière d’amener les consommateurs en espèces (généralement non bancarisés) à une plateforme de paiement numérique, en remplaçant les transactions en espèces par des transactions numériques. Je pense que cette approche est une mauvaise lecture de la situation. L’inclusion des paiements est une question de choix, pas nécessairement d’adoption généralisée des paiements numériques. N'importe qui peut être confronté à une exclusion de paiement, qu'il s'agisse d'un consommateur en espèces essayant d'utiliser un système de bus utilisant uniquement des cartes ou d'un consommateur numérique essayant d'acheter de la nourriture dans un chariot de nourriture en espèces uniquement. Ce dont les deux consommateurs ont besoin, c'est de pouvoir opérer dans leur système de paiement préféré, mais aussi d'avoir la possibilité d'accéder à l'autre système de paiement (qu'il soit numérique ou en espèces) selon leurs besoins et selon leurs propres conditions.

Mais, en pratique, il est plus difficile pour un consommateur utilisant des espèces d’entrer dans le monde numérique que pour un consommateur utilisant le numérique d’entrer dans le monde des espèces.

Ce que nous devons donc découvrir et développer, ce sont des rampes d'entrée et de sortie entre l'argent liquide et le numérique, qui permettent aux consommateurs utilisant de l'argent liquide de rester dans un système de paiement qui, entre autres choses, met l'accent sur les interactions personnelles, le caractère physique de l'argent et l'immédiateté de l'argent. transactions, mais leur permet également d'effectuer des paiements numériques quand ils en ont besoin. Dire aux gens d’ouvrir un compte bancaire est à mon avis un peu erroné et condescendant.

C'est ici que la #techfin de Nouvelle Génération #surebanqa entre en jeu avec un écosystème de services d'inclusion financière, qui tient compte des exigences du numérique et du paiement espèces à travers le couplage #loop+#qikqik( Paiement, Bancaire,...)+#xenn+#afrinodes où les parties prenantes vont pouvoir transiger en argent physique ou digital selon leur choix et besoin, ce qui permet d'établir un pont entre le passé, le présent et l'avenir des paiements, la banque, la monnaie, ceci grâce à ses piles technologiques innovantes disruptives et à l'épreuve du temps.

#financialinclusion #banking #paiement #innovation #embeddedfinance #openbanking #blockchain

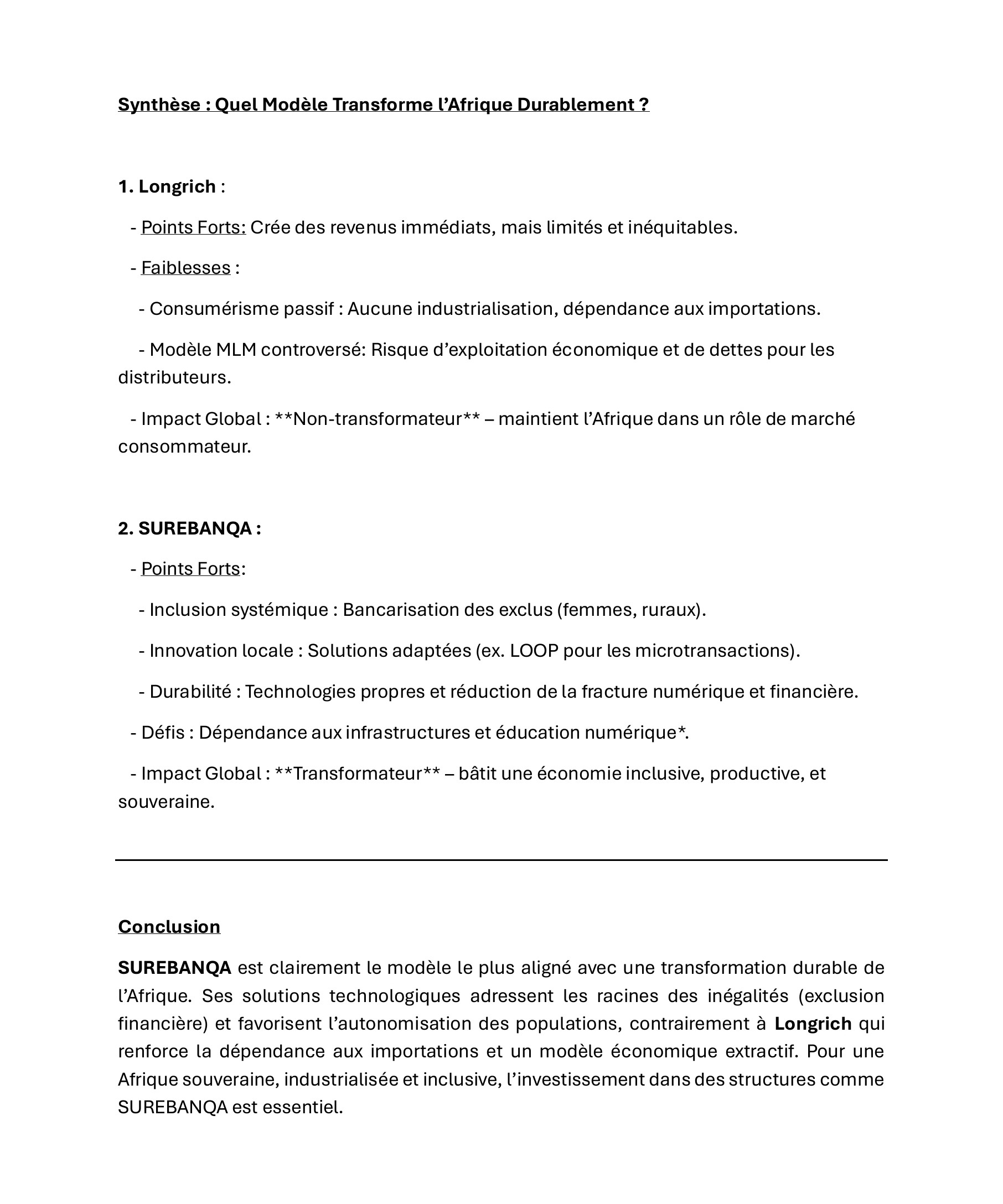

Analyse Comparative : *Longrich vs. SUREBANQA pour la Transformation et le Développement Durable de l’Afrique*

Selon l'IA *DeepSeek*

Aperçu : Ce document ( *en images, voir les commentaires* ) compare Longrich et SUREBANQA quant à leur impact sur la transformation et le développement durables de l’Afrique.

**Contexte et Raisons d’Être**

- Longrich se concentre sur la vente de produits de santé et de beauté via un modèle de marketing multi-niveaux (MLM).

- SUREBANQA vise à démocratiser l’inclusion financière grâce à des solutions technologiques innovantes telles LOOP joinloop.one, QikQik.plus, etc. pour les personnes non bancarisées, en particulier les femmes des zones rurales.

**Tableau Comparatif Avantages et Inconvénients**

- Longrich fournit un revenu immédiat aux distributeurs, mais dépend des produits importés, faute d’industrialisation locale.

- SUREBANQA offre un revenu durable à long terme, une autonomisation financière et la création d’écosystèmes locaux grâce à des plateformes financières innovantes.

**Synthèse : Quel Modèle Transforme l’Afrique Durablement ?**

- Longrich génère des revenus limités et inéquitables, perpétuant le consumérisme et la dépendance aux importations.

- SUREBANQA promeut l’inclusion systémique, l’innovation locale et la durabilité, construisant une économie productive et souveraine.

**Conclusion**

- SUREBANQA s'inscrit davantage dans une démarche de transformation durable en Afrique, en s'attaquant à l'exclusion financière et en favorisant l'autonomisation, contrairement au modèle extractif de Longrich.

La Triste Réalité de la fuite des cerveaux dans les pays

Le phénomène de la fuite des cerveaux se produit lorsque les travailleurs les plus talentueux et les plus brillants des pays pauvres émigrent vers les pays riches, à la recherche de salaires plus élevés et de meilleures conditions de vie. Cela peut entraver le développement des pays pauvres car bon nombre de leurs meilleurs travailleurs partent.